AppWorks Year Two Reflection

Just hit my two-year mark at AppWorks. Had time to reflect during a recent US trip. Been quite the journey - exciting moments, some doubts, but overall pretty rewarding. Here's my breakdown of year two reflection:

Crypto Market Take

There's this weird mismatch in crypto right now between primary/secondary market funding and participant structure. Short-termism is everywhere. Most successful crypto business model? Asset issuance and related services. Big question for this year: what's the next asset to be issued on-chain after gold and USD? And what barriers need solving for existing on-chain assets to scale further?

Primary Market Investment Lessons

Been working on using empathy to connect better with founders, accepting investment imperfections, pricing risk properly, distinguishing between optimism and over-promising, and valuing transparency.

Year Three Focus

Continuing to leverage media, software, and capital. Probably need to double down on all three.

Crypto Market Observations

There's a strange feeling of confusion in crypto now. VCs pulling back after meme season, people blaming exchanges, VCs, and political families for being "bloodsuckers not builders," founders giving up and thinking the market only wants tokens, not products.

The root issue? Secondary market participant structure is out of balance. Traditional stock markets are mostly institutional investors focused on long-term value. Crypto markets? Mostly retail traders chasing short-term gains. Token prices and exchange listing requirements end up more influenced by community hype than product strength or team quality.

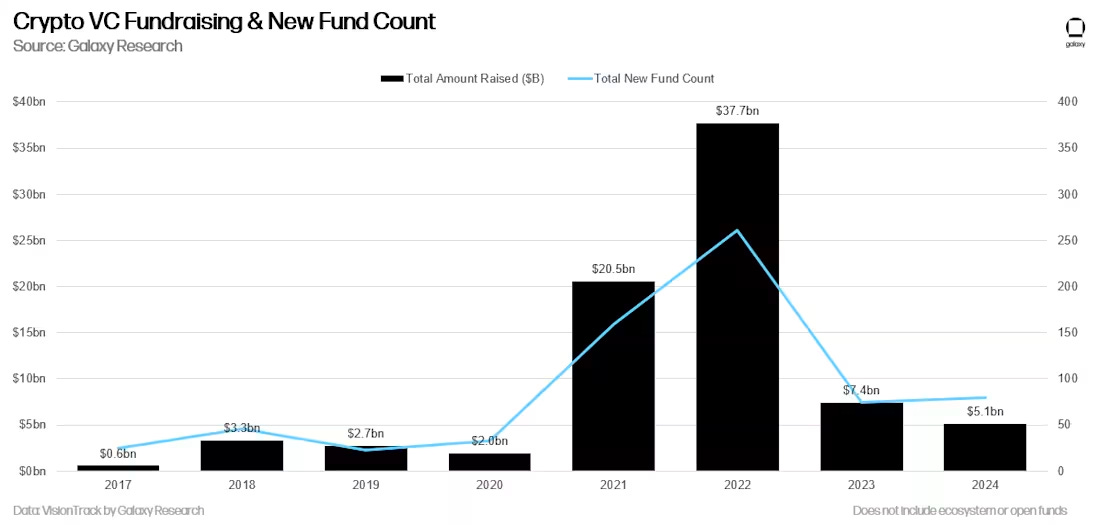

Beyond participant imbalance, institutional capital scale differs between primary/secondary markets. Crypto VC fundraising peaked in 2022, with funds needing deployment over 2-3 years. Result: VCs competing aggressively (pushing valuations up) but fewer institutions in secondary markets creating a funding mismatch. More Crypto VCs are moving into secondary markets, but with shorter fund cycles (many ending in 1-2 years), most still maintain short-term thinking, requiring portfolios to TGE and exit this bull run.

Why so few fundamentals-focused liquid funds? Probably because there's not much worth investing in if you're using value investing methods. Uniswap has decent revenue but still 0% gross margin. Still comes back to what I said a year ago – not many applications people consistently pay for. So far only Ethereum/Tether/Lido/Uniswap possibly generating $1B+ revenue.

Crypto's Successful Business Model

Looking back, crypto's most successful PMF boils down to one thing: asset issuance. Success cases include:

Issuing gold (BTC)

Issuing currency (USDT/USDC)

Issuing memecoins (pump.fun)

On-chain issuance of market-valuable assets (RWA)

Computing power/hardware (DePin)

Tokenizing non-assets like AI agents (Virtual)

KOL influence / content quality (Kaito Yap)

Businesses surrounding asset issuance – asset management, brokerage, exchanges, market makers, data analytics – are among the few actually making real money.

Honestly, only gold and USD have truly succeeded. What conditions would other assets need to match their success? Both gold and USD had distribution problems that on-chain issuance solved.

Blockchain's Core Value: Global Verifiability

The fundamental reason blockchain solves distribution problems is its verifiability. Americans can quickly send money to Japanese people because everyone can see the addition and subtraction between addresses on a public ledger. This global verifiability is blockchain's most unique value. Digital systems could already verify things, but blockchain's public ledger enables global verification. Verifiable credentials can range from passport/license global verification to company equity registration (a founder told me ARCA broke down and a share buyback from months ago still can't be updated – if equity was registered on-chain, wouldn't it just be one transaction?), to industry license certifications or bank deposit proofs.

Global verification could also work for agent performance benchmarking. If agent execution happens on-chain, it's easily verifiable. For example, with 100 DeFi agents, how do you know which performs best? Check their execution history – all public. USV's invested in a company building a neutral performance evaluation system based on verifiable performance.

So What Makes Me Excited?

Based on the above, several areas could become important crypto commercial applications:

Enterprise financial services built on stablecoins: Stables payments naturally extend to enterprise finance. Payment records enable trade financing. On-chain global verification allows automated billing/reconciliation systems. Could even have agents perform audits, issuing proofs confirming compliance with on-chain data.

DEFAI: Gives DeFi new distribution channels. Composability (blockchain's most cited value) manifests in various yield and arbitrage strategies. AI reduces this compositional complexity, while DeFi's composability gives agents more room to operate (no need to rely on centralized apps opening APIs), enabling more customized strategies. Looking forward to personal quantitative trading AI assistants helping average people optimize their financial asset allocation.

Agent benchmarking system (verifying agent work quality): Blockchain's public ledger might be ideal for evaluating AI system performance.

What agents with wallets and asset rights can do: They can independently allocate capital to achieve goals, like buying more computing power or hiring other agents. Multiple agents can organize cooperation, jointly funding specific tasks. Wallet-equipped agents can develop budget concepts, learning to complete tasks efficiently at lowest cost.

What other assets are suitable for tokenization? Attention and influence tokenization concepts are fascinating since attention is the ultimate scarce resource. Social media, gaming, entertainment industries ultimately compete for user attention. Asset pricing is the hardest step in any new asset issuance. Kaito attempts to price attention through content quality, though details of their pricing algorithm remain unclear. The key is their business model must build on content quality algorithms. When their quality assessment algorithms become more accurate, they earn more, creating a positive cycle. Without this, they'll be like traditional media, earning only from traffic rather than content quality, eventually replaced by subscription models. Google Search is the best example – higher search result quality means more profitable keyword ads.

Takes from Primary Market Investments

In my second year at AppWorks, did 6 cases, invested in 4, missed some good opportunities. Publicly disclosed investments include Bythen, Gashawk, and SignalPlus (investment logic in links, open for collaboration discussion).

Always aiming to find good founders and help them achieve their goals. Had many insights about evaluating founders in my second year (see previous Substack article). Some new takeaways:

Empathy

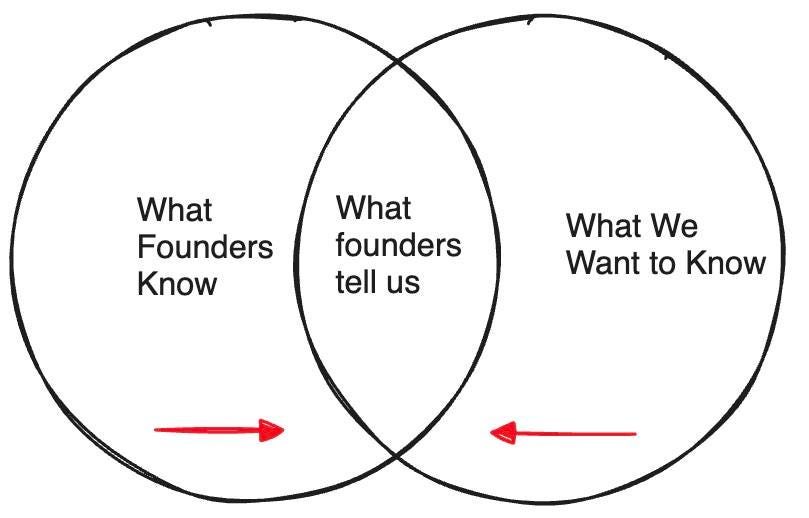

Investment's essence is finding information gaps.

Unlike secondary markets where industry analysis and market data drive decisions, early-stage investing relies more on understanding and trusting founders. Early-stage information asymmetry is more severe, with most important information coming from founders. "Sitting on the same side of the table as founders rather than opposite" becomes more important, and empathy is a key skill for closing the distance with founders. They'll share company struggles despite knowing you're an investor, share industry insights despite competitive concerns.

Simply put, it's about expanding the intersection between what founders know and what you want to know, getting more information for better judgment. But as a straight guy, I habitually challenge founders' views. Once they feel you're on the other side of the negotiating table, they put on masks, replacing real sharing with prepared content, especially soft information unrelated to market or product but often crucial.

Some useful techniques:

Listen to understand, not to answer

Share your experiences to express understanding feelings, helps close distance with founders

Repeat their views in your words, label them if possible – they'll usually share more regardless of agreement

Use 5W1H for questions (When, What, Who, Where, Why, How), not just Why and How (which founders have practiced answering thousands of times) – knowing When, What, Who, Where helps better understand the founder's complete thinking process

Ask open-ended questions like "If resources weren't an issue, how would you handle this problem?"

Accepting Imperfect Investments

If your bargaining power isn't high, seeking perfect deals only costs you more. Most deals have imperfections – TAM not large enough, competitive advantage not strong, etc. Everyone knows not to go where crowds are, but perfect deals attract fierce competition. Being alone where others aren't can be brutal when you make mistakes. Early-stage investments mostly involve mistakes, which is hard to overcome psychologically. Just remind yourself not to view risks as binary 0 or 1, try to measure risk and reflect it in pricing. Making mistakes alone lets you level up alone.

Optimism vs. Over-promising

Often the key to investment decisions is the trust to founders, and a good way to build trust is maintaining "underpromise, overdeliver." Founders with over-promising habits make follow-up exhausting and erode trust. However, all founders should be optimists (otherwise they wouldn't choose entrepreneurship). So how to distinguish optimists from over-promisers? The key is transparency and attitude toward failure. Optimists honestly share difficulties, don't blame external factors, while over-promisers often avoid discussing difficulties or admitting failure. Showing vulnerability also means being able to see reality clearly – not necessarily bad. Founders willing to genuinely share current difficulties are truly trustworthy.

Adaptability vs. Difficulty Avoidance

AppWorks has a 3H framework for evaluating founders, including "hand," easily viewed as traction. Looking only at traction would miss good founders pivoting, but how to know if constantly pivoting founders are actively adapting or avoiding difficulties? Some teams keep trying new problems, constant pivoting is fine, but are pivot decisions based on data? Do they help teams accumulate more strength or resources? Are they getting clearer on ICP? Does the core team remain intact during continuous pivots? These are good validation criteria.

Delta vs. Volatility

Another founder quality AppWorks values is delta – growth speed. But recently realized investing in founders is like investing in options – we need maximum value within fund duration. When the underlying (entrepreneur's ability and business) rises, option value naturally grows (delta > 0), but volatility is also an important value source. Founders who've weathered storms often grow faster. Seemingly risky founders know how to use leverage to increase volatility – although surface failure risk seems high, successful returns are substantial. Also, Investing in founders differs in being a "multiple option." Even if this venture fails, trust capital built with founders can work again in the next opportunity. This is partly why many prefer younger founders – the time value of this multiple option is higher.

These soft skills and thinking angles are seems trivial but actually qutie crucial for founder investment. Empathy lets me sit on the founder's side, accepting imperfection prevents missing deals, distinguishing optimism from over-promising helps identify true resilience, and seeing volatility's value lets me see more possibilities.

AppWorks Year Three Focus

One quote deeply influences me, from Naval's "How to get rich (without getting lucky)" – you need three things: specific knowledge, accountability, and leverage. For me, specific knowledge and accountability come from regular work practice, but leverage requires deliberate practice. Leverage takes many forms: labor, capital, software, media, etc. Here are my experiences using media, software, and capital leverage:

Media / Writing

Always wanted to maintain regular article output but faced common problems: can't find time, overthinking (fear no one will read, topic overdone). This past year, I've heavily used AI to increase writing productivity.

Recently actively using AI to help me think, discover article blind spots, even stimulate new perspectives. Learned a great method from Zhou Jiaan's article that works well. He uses Johari Window to classify knowledge:

Blind spot: LLM knows, I don't – helps identify blind spots

Hidden area: I know, LLM doesn't – checks if article context is sufficient

Unknown area: Neither I nor LLM knows – most valuable area, helps discover valuable new perspectives

Interacting with LLMs reduces hidden and blind areas, continuously exploring and clarifying the unknown area. Many complain Deep Research's biggest problem is not knowing if findings are accurate, so using this method to identify blind spots between you and large models is effective.

I've been using AI to translate my Chinese posts into English, but they often sound robotic. My LinkedIn and Facebook followers are similar in number, yet LinkedIn's English engagement is lower. So I'm training an AI to produce more natural-sounding English content to boost engagement.

But I've also been thinking: if AI writes so well, why write at all? Recently heard a perspective that resonated—writing helps you think clearly. Digitizing your thoughts and pairing them with AI lets you build a second brain making it easier to connect ideas and spot patterns.

Finally, I strongly agree we're now in an era of curators (maybe we always have been). Sharing the right content with the right audience now matters even more than creating it yourself.

Software

Last year, I built several workflow automations using Apps Script, no-code tools, and LLMs, and even created a trading bot with Cursor. With 2025 being labeled the "Year of Agents," I'm eager to integrate more agent-based workflows into my daily tasks. Initially, I thought about diving into LangChain but found n8n or Zapier sufficient. Now, with the emergence of MCP and Manus, I'm reconsidering which tools are best suited for my needs.

I've narrowed down two main agentic workflow methods:

Deterministic workflows: Integrating LLM capabilities into clearly defined workflows for structured data extraction and organization (best suited for no-code tools combined with LLMs).

Agent-driven workflows: Using conversational agent frontends to let AI dynamically determine required data and tools, including task verification (best suited for tools like MCP).

Here's how I'm planning to implement agentic workflows for our VC activities this year (happy to discuss with anyone interested!):

First Call Prep: Automating the enrichment of deal pipeline data, founder backgrounds, and basic company analyses. Currently developing features to parse docsend, web links, and PDFs, and to integrate more databases. (Method 1)

Due Diligence (DD): Conducting deep founder assessments using my personal founder quality guides and first-call insights

Playing Devil's Advocate: Using AI to intentionally identify reasonable arguments against mainstream perspectives, helping uncover hidden biases or blind spots. (AI's suggestion—love this idea!)

Post-investment Tracking: Creating dedicated agents for each portfolio company to summarize weekly logs and quarterly financial updates.

Thesis Reviewing: Extracting insights from meeting transcripts to regularly review key industry discussions with founders. Currently evaluating security and privacy implications with API integrations (e.g., Otter.ai, OpenAI Operator).

Looking forward to seeing how these integrations shape my workflow efficiency!

Capital

Finally, capital leverage – deliberately practiced for years, including auto loans, personal loans, mortgages, actively refinancing when finding cheaper funding. Because I'm lazy about constantly monitoring markets, I prefer leverage methods that won’t get liquidated. Off-exchange personal loans and mortgages work great, but it's crucial to carefully calculate monthly repayments to avoid making irrational decisions. Conservatism is key here!

I've also experimented with managing funds for family—another great example of non-liquidatable leverage. To scale this effectively, last year I transitioned our spreadsheet records into a structured fund model that clearly shows investment amounts and NAV performance, letting family members join or exit anytime. This year, I plan to use AI to automate report generation, making the investment status clear and professional. Recently, I fed my spreadsheets into Claude and surprisingly got back interactive reports! Next step: automating real-time net value updates, though I foresee backend issues making this part a bit tricky.

Future considerations:

What other non-liquidatable leverage exists? AI suggested options I haven't tried: 0% interest installments for large purchases, life insurance loans, etc. Will research and try in future.

Or use automated monitoring tools for liquidatable leverage (margin trading/leverage arbitrage)? Honestly, that area is super complex—can’t wait until there's an AI quant manager smart enough for me to trust!

Finally, I'm always thinking about the synergy between capital, software, and media leverage. Working in VC naturally combines all three. Packy McCormick is a great example—he started by gaining insights through writing, built his influence via media, and eventually raised funds to leverage capital. He shared how AI helped accelerate his writing, now generating over $3M annually just from his newsletter alone—not even counting performance from Not Boring Capital. Practicing these three forms of leverage and applying them actively at work will be a key goal for me this year.

Thanks for reading this long article, see you next year! Then I'll share how many of this year's hopes were realized. Hope I can over deliver!